Lulubox Pro

Hey guys, are you fond of playing mobile games? Do you like to play the latest video games on your mobile device? If yes! Then welcome to our post, where we will talk about the most popular application that is very beneficial and essential for all gamers. The name of the app we are talking about in this post is Lulubox Pro.

- 1 What Is Lulubox APK?

- 2 How Does This App Work?

- 3 Features of Lulubox Pro APK

- 3.1 Unlock Premium features and in-app purchases

- 3.2 Unlimited Skins and Characters

- 3.3 Game Modification

- 3.4 Application Clone

- 3.5 Boost Gaming Experience

- 3.6 It supports Lots of Games

- 3.7 No Need Root For Lulubox

- 3.8 No Extra App is Required to install the app

- 3.9 Five themes for PUBG

- 3.10 block ads, remove bloatware, and customize the interface

- 3.11 A user-friendly interface

- 4 How To Use Lulubox Apk?

- 5 How To Use Lulubox Garena In Free Fire

- 6 How To Use Lulubox In Pubg Mobile?

- 7 Supported Games on Lulubox

- 8 How To Add Games In The Lulubox Pro App?

- 9 Block Calls and Banners Notification With The Lulubox App

- 10 Advantages of The Lulubox Pro App

- 11 Disadvantages of Lulubox

- 12 How To Download Lulubox Pro APK?

- 13 App Details

- 14 Frequently Asked Questions

- 14.1 Is Lulubox real?

- 14.2 Is Lulubox APK is legal?

- 14.3 Is the Lulubox app safe?

- 14.4 Can I use Lulubox on my iPhone or iOS?

- 14.5 How To Fix Lulubox Error?

- 14.6 Can I use Lulubox Pro APK on my Laptop or Computer?

- 14.7 Is it necessary to give the Android app permission to download Lulubox Apk?

- 14.8 How to get Free Fire Skins with Lulubox?

- 14.9 Is Lulubox safe for Free Fire?

- 14.10 Does Lulubox boost the Gaming Experience?

- 14.11 How do I activate Lulubox?

- 14.12 Is Lulubox App Free?

- 15 Wrapping up

This application is one of the best ways to unlock all the premium features in your favourite Android games. It is an Android-based application programmed to unlock the premium features like unlimited coins, Gems, and Reskinning gfx of any Android-based video game for free.

Friends, many people are playing mobile games like GTA 5, Free Firee, BGMI, and Minecraft throughout the day and like playing these games very much. If you are also playing these games on your Android phone, you must notice that these games have such features that we can’t get quickly, and to get them, we have to pay huge money.

To solve this issue, such developers created an app with the help of which you can access these premium features for free at any time. The name of that free mobile app is Lulubox which allows users to access all the in-app purchases of any popular video game for free.

If you desire to learn more about this application, read this post, as here we will share complete information about Lulubox and Lulubox Pro APK. In today’s post, you will get to know what Lulubox is and how it is helpful to access in-app purchases of any game. So without wasting much time, let’s start the review of this app.

What Is Lulubox APK?

Lulubox Apk is the most popular Android application specially designed for gamers. This site works like a tool through which you can get all the premium and in-purchase features like skin, loot box, costume bundles, free diamonds, unlimited coins, and many more. You can access all these premium features of any popular Android game for free without spending a penny. This application is the one-stop solution for all your mobile gaming needs.

Playing games is one of the best and oldest ways to get yourself entertained in your free time, and now the popularity of video games is too high because of cheap internet and advanced smartphones. That is why we can observe that almost everyone, from kids to elders, started playing video games on smartphones throughout the day, which led to the popularity of video games increasing.

If you are also fond of video games like Free Fire, BGMI, GTA 5, Minecraft game, and others, then you must be aware of their in-app purchases and premium features. Are we right? If yes! Then you also know that we have to pay money to access these premium features and in-app purchases.

Many gamers are spending vast amounts of money on these kinds of stuff as, with them, the gameplay of any game is more accessible, but many players need more money to afford them. That’s why they are always looking for tools and platforms to access these in-app purchases and premium features for free. For those people, Lulubox Apk is like a bone that allows gamers to unlock premium features in certain Android games for free.

How Does This App Work?

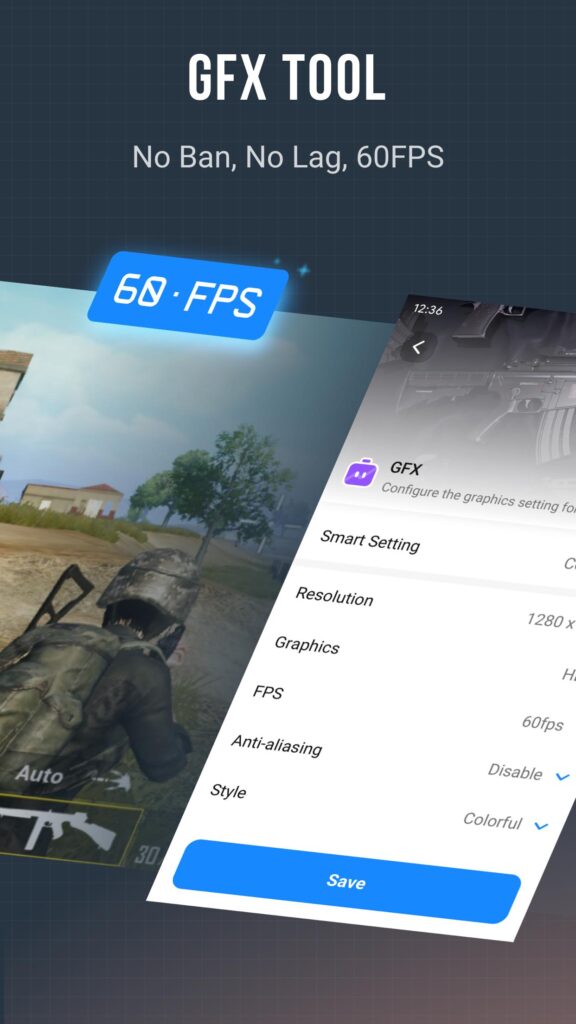

Lulubox Apk is just like a third-party tool that provides a “plugin” for the game that modifies the code of any game to give the unlocked features. It also has a built-in game booster that helps enhance games’ performance on a low-end device. This site was primarily dedicated to gamer lovers looking for a free tool to access the premium features and in-app purchases without paying any money.

The Lulubox site was top-rated among gamers due to its premium unlock features, through which you can freely access premium items like diamonds, coins, skins, skills, emotes, bundles, and many more on your favorite game. This app also helps gamers to block ads, remove bloatware, and customize the interface of certain apps. It is also beneficial to increase battery life during gameplay.

Many premium locking apps are available on the internet, but this Lulubox app is entirely genuine and different from others. Gokoo Technology developed it; currently, over 500 Million users are using this app worldwide.

If you also want unlimited coins, free diamonds, skills, skins, and other premium features on your favorite game, then you can download this site and use it to unlock any game. Now you can also download its pro version, which was recently launched with the name of Lulubox Pro APK. Through this pro app, you will get many more features to help make your gameplay more manageable and smoother. If you wish to know about these features of Lulubox APK, follow this page until the end.

Features of Lulubox Pro APK

Here we will discuss such unbelievable features and advantages;

Unlock Premium features and in-app purchases

It is one of the most prominent features of Lulubox APK, through which you can unlock premium features and in-app purchases of any video games like BGMI, Free Fire, Pubg, GTA, Roblox, and others. With this app, you can access all the premium features like elite passes, royal passes, and many others without spending a penny.

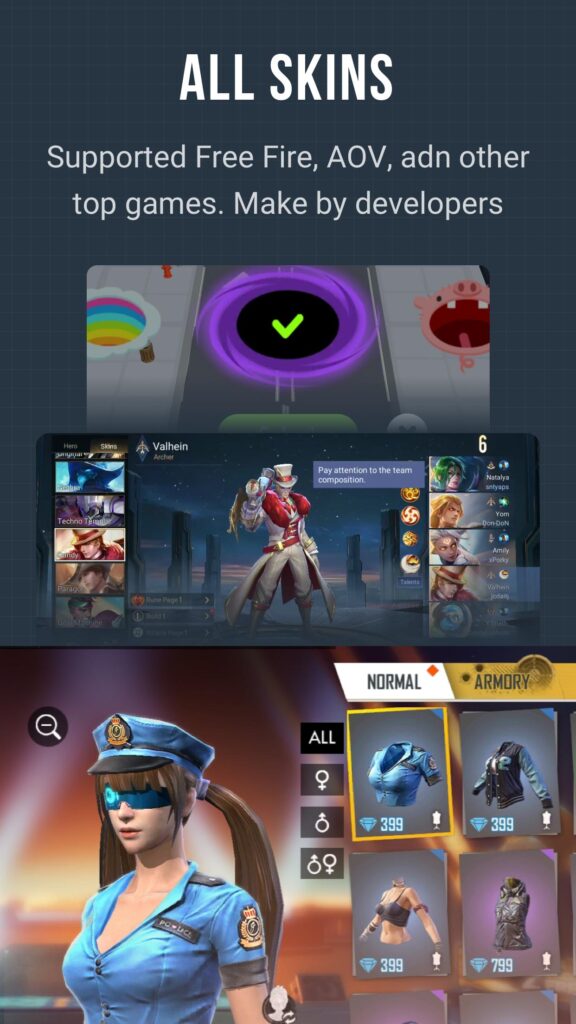

Unlimited Skins and Characters

This application allows users to access unlimited skins and characters on their games, battle royals, and other games. As we know today, everyone likes to play RPG battery royal games where different characters and their skin play an essential role, which is why this app allows gamers to access unlimited skins and game characters for free.

Game Modification

The Lulubox app features a fantastic plugin that helps gamers modify their favorite games according to their imagination. This plugin also allows gamers to unlock all the premium features and in-app purchases for free.

Application Clone

With this app, you can make clones of your favorite game and run them through different game accounts. This feature benefits gamers who want to play their favorite game without limits or errors.

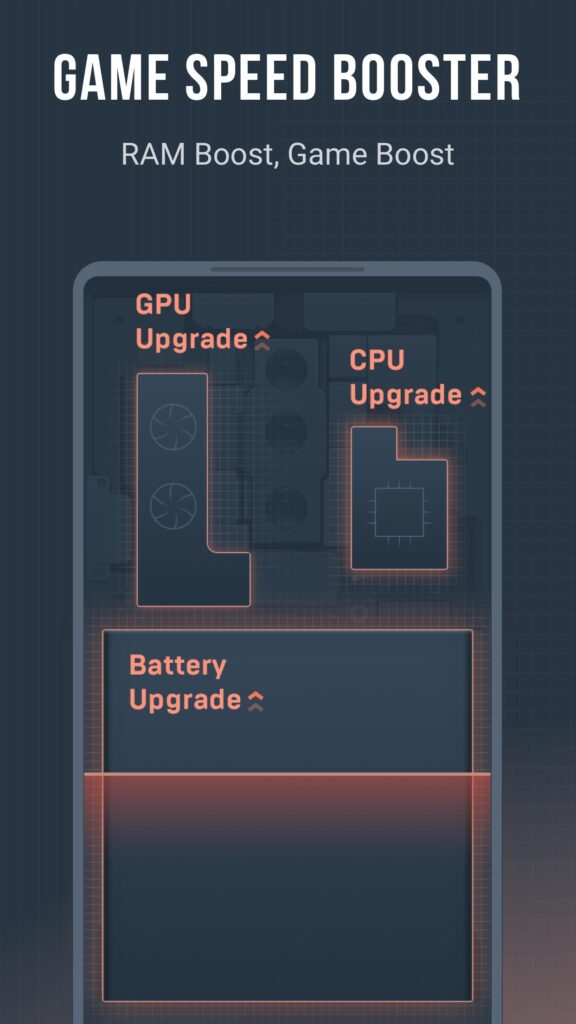

Boost Gaming Experience

With its built-in game booster, this application can boost the gaming experience in low-end devices. Those gamers who play video games on their low-end devices can use this application to enhance their gaming experiences and play games smoothly.

It supports Lots of Games

This application is the perfect tool to boost the gaming experience and unlock the premium features of video games. The best thing is it supports lots of games like Basketball Stars, Shadow Fight Arena, Blossom Blast, Among Us, Free Fire, and many more. If you are also playing these games, you can use this Lulubox app to make it easier and smoother.

No Need Root For Lulubox

If you want to use this application, you don’t need to root your device and can easily download and install it on your device. Device rooting is very harmful to any device; that can affect your smartphone’s warranty and drain its battery. That’s why an application like Lulubox doesn’t require device rooting. We also suggest you avoid mobile rooting as much as possible.

No Extra App is Required to install the app

This application also doesn’t need any third-party app to get installed on your device. If you desire to utilize it, you can directly download it on your android phone and install it now without the help of any app or device rooting.

Five themes for PUBG

This application is perfect for you if you are a PUBG player, as it offers five latest themes for PUBG games. You can use these free themes on your PUBG match and make them more attractive and accessible for you. With this app, you can unlock many premium features and in-app purchases of PUBG without spending any money.

block ads, remove bloatware, and customize the interface

Using this app on your favorite video games will also help you block ads, remove bloatware, and customize the interface for free.

A user-friendly interface

Lulubox is a perfect app to unlock premium features and in-app purchases for free, and the best thing is that it comes with a user-friendly interface so that anyone can easily use it.

How To Use Lulubox Apk?

So, friends, after learning about the features of Lulubox Pro APK, you must wonder how to download and use it on your favorite games. Are we right? If yes! Then here we have the ultimate guide for this application through which you can learn how to use Lulubox. So please read the following steps to know about it.

Step 1: To use this application, you have to download it from the given download link on this page. After downloading, click on the install button to start the installation. If Google Play protects shows a warning, ignore it. It’s not a virus.

Step 2: Now open this app and check the list of all games to select the game that you want skins, like Pubg Mobile

(We are sorry if you are playing games on iPhone or iOS. This application was designed only for Android devices, so you can’t use it on your iPhone.)

How To Use Lulubox Garena In Free Fire

Nowadays, the popularity of Battle Royal games among gamers is too high, and millions of people play Garena Free Fire regularly. If you are also a Free Fire player, you must know that this game comes with many in-game purchases like seasonal Elite passes, Diaomons, Membership plans, costume cards, Weapon skins, emotes, and many more. We have to spend lots of money to get all these things, but if you want to get them free, you can use Lulubox Pro APK on your game. With this application, you can access all these things for free.

- Install this app on your phone to use Lulubox APK on your Garena free fire game.

- Then select the Garena free fire from the game list of this app.

- Now allow all permission it requires.

- Congratulations, now you quickly access lots of free skins, coins, diamonds, Elite passes, Memberships, and many more in the free fire.

How To Use Lulubox In Pubg Mobile?

Not only in Free Fire, but you can also use this application to unlock the Pubg mobile game. Follow the methods given below to use this app on PUBG mobile.

- Install this app on your Mobile

- Once the application is installed, find the PUBG mobile game from the game list on this app.

- Install the PUBG mobile game on the Lulubox app and add the plugin to unlock all the premium features and in-app purchases for free.

- Congratulations, now you can access all the premium features and in-app purchases of PUBG for free.

Supported Games on Lulubox

So friends, apart from PUBG and Garena Free Fire, many other video games are available on the Lulubox game list on which you can use this tool to unlock their premium features. Now we will list the video games that support this tool.

- Basketball Stars

- Shadow Fight Arena

- Blossom Blast

- Among Us

- Mini Militia

- Clash of Clans

- Subway Surfers

- Multiple Space

- Mobile Legends: Bang Bang

- 8 Ball Pool

- Shadow Fight 2

- Shadow Fight 3

- Ludo king

- Clash Royale

- Overlords of Oblivion

- Call of Duty

- Top War

- Worms Zone .io – Voracious Snake

- Racing in Cars 2

- Need For Speed

- Hill Climb Racing

- Subway Princess

- Crazy Juice

- Crowd City

- Archero

- Johnny Trigger

- Coin Master

- Sniper 3D

- Crowdcity

- Subway Princess

- Free Fire Advance Server

How To Add Games In The Lulubox Pro App?

Apart from this list, you can add your favorite games to this application to unlock their premium features and in-app purchases. To add any other video game on this app, click the add button and select the game you want to add.

Block Calls and Banners Notification With The Lulubox App

If you are worried about frequent calls, messages, and notifications during gameplay, then with this tool, you can block these calls and messages for free. It will also help you to ban all notifications during gameplay.

Advantages of The Lulubox Pro App

- It makes it easy to find and play a variety of games.

- Supports a wide range of video games

- Maintains game quality and keeps it the same.

- Rooting is not required to install Lulubox.

- There are five themes available for PUBG.

- All plugins are free.

- Chat rooms are also available for gamers.

Disadvantages of Lulubox

- You cannot download direct games in it.

- I can’t play from the app.

- It is challenging to launch and shut down.

How To Download Lulubox Pro APK?

This is not available on PlayStore. Therefore, to download Lulubox Pro, you must go to the official website of Lulubox, where you can download it for free. You can follow the steps below to download Lulubox Pro 6.6.0 or other versions of Lulubox.

- First of all, search on Google by writing ‘Lulubox Apk.’

- Go to the official website of Lulubox. Pro.

- Here you will get the Lulubox APK Download button. Click on it.

- Lulubox APK will start downloading on your Mobile.

App Details

| App Name | Lulubox |

| Size | 16 MB |

| Category | Gaming, Editor Tools |

| Root Required | No |

| Downloads | 36.5M |

| Version | 6.18 |

| Developer | Gokoo Technology Pte.ltd |

Frequently Asked Questions

Wrapping up

Lulubox Pro is the best tool for gamers. You, too, can collect unlimited coins and skins using Lulubox and enjoy your favorite games to the fullest. If you adore playing games on your Android Mobile, then Lulubox can improve your gaming experience. With this, you can upgrade and modify your games on time.

We have told you the complete Lulubox APK Download process in this article and other important related information. We hope you have liked this article. Still, if you have any questions or suggestions about this article, please comment below.

Lastly, share this article with your friends and gaming partners so they can also experience the fun of online games every single time.

Lulubox Pro

Customize and optimize your favorite games with using this application. Easily install unlimited skins, mods, and plugins for your favorite games like Free Fire, Carom Pool, and many more.

Price Currency: USD

Operating System: Android

Application Category: Game

4.9